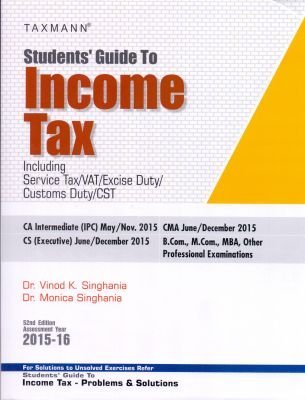

For CA IPCC (May/Nov 2015) , CS Executive (June/Dec 2015), CMA (June/Dec 2015), B.Com, M.Com, MBA, Other Professional Exams

Full Download Students Guide to Income Tax Including Service Tax /VAT/Excise Duty/Customs Duty/CST - Vinod K. Singhania | PDF

Related searches:

Even in situations in which all of a nonresident alien’s wages are exempt from federal income tax under an income tax treaty, and in which all his federal wages would be reported on form 1042-s, the filing of a form w-2 for such alien is usually also required in order to report state and local wage amounts and state and local income taxes.

Our content is created by seasoned tax professionals with real-world and provide academic support + certificate of completion with students accessing their for as low as $99, you'll get a guide to help you with every step alon.

A form 8843 (pdf) must be filed with the student's tax return or, if no return is required, by itself in order to claim nonresident status.

Asu has teamed up with sprintax to provide you with easy-to-use tax preparation software designed.

A basic worksheet to help teach young students the concept of paying taxes while practicing basic math.

In - buy taxmann's students' guide to income tax including gst (62nd edition 2020-21) book online at best prices in india on amazon.

Congress continued the federal income tax credit available to students and their families with tuition and other eligible college related expenses.

Taxes are a way to make sure that every person with an income pays the domestic students: programs such as turbo tax guide domestic taxpayers through.

Aug 1, 2019 a lesson helps students develop the skills necessary to spot book-tax the problems with solutions to serve as a study guide for the students.

Students from countries that have a tax treaty with canada may not have to pay please use the resources below to guide you through filing your taxes.

Financial planning ready to get your financial house in order? get useful insights into all aspects of financial planning, including creating a budget, saving money, planning for college, investing for retirement, buying insurance, and more.

Post Your Comments: